- Income Tax Bill 2025 allows full tax deduction on commuted pension from approved pension funds.

- Non-employees like independent professionals, nominees, and legal heirs now qualify for this tax benefit.

- Eligible pension schemes include government, private superannuation, and third-party self-purchased pension funds.

Income Tax Act 1961 Provisions on Commuted Pension have been made clearer with the new Income Tax Bill 2025, which clearly allows pension funds to get full tax deduction on commuted pension from approved pension funds. This update makes sure all pension recipients, including non-employees, get fair tax treatment under the Income Tax Act. If you get a commuted pension from specified funds like LIC Pension Fund, this bill will affect your tax liabilities a lot.

What Full Tax Deduction on Commuted Pension Means

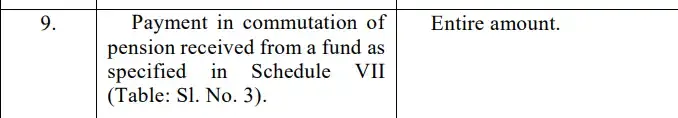

Income Tax Bill 2025 has added clear rules allowing the whole amount of commuted pension to be deducted from taxable income when it comes from approved pension funds listed in Schedule VII of the bill. This is a big step in clearing up tax benefits for pensioners.

What is Commuted Pension and How Does Tax Work on It?

Commuted pension means a lump sum payment a pensioner gets instead of regular pension payments. Before, the tax rules for commuted pension were unclear, especially for those getting it from approved pension funds but not as employees. Under the Income Tax Act, 1961, Section 10(10A)(iii) along with Section 10(23AAB) allowed full tax exemption on commuted pension for employees and payments from approved funds like LIC.

The new bill makes it clear that this exemption fully applies to all recipients from approved pension funds, so no one is unfairly taxed on their commuted pension.

How the Lok Sabha Select Committee Helped Clear Up Tax Deductions

The Lok Sabha Select Committee looked at Clause 19 of the Income Tax Bill 2025 and found a gap in fair tax treatment. While employees were given exemption, non-employees getting commuted pension from approved funds were left out. The committee suggested clearly allowing deduction under “Income from Other Sources” for non-employees, matching the bill with existing law and making it fair.

This suggestion led to adding Section 93(1)(g) in the updated bill, giving full deduction on commuted pension to non-employees.

Who Are Non-Employees Under the New Tax Bill?

Non-employees are people who get commuted pension from approved pension funds but don’t have an employer-employee relationship with the pension contributing organization. This widens the group of people who can benefit beyond regular employees.

Also Read – How to Pay Zero Tax on ₹16.75 Lakh Income Under New Tax Regime

Examples of Non-Employees Who Can Get Tax Deduction

- Independent professionals who have invested in approved pension funds.

- Nominees or legal heirs getting pension payments after the original pensioner has passed away.

- Beneficiaries under group insurance-linked pension plans without employment contracts.

Types of Pension Schemes That Qualify for Tax Exemptions

Experts say pension schemes that qualify for tax exemption on commuted pension under Section 10(10A) of the Income Tax Act, 1961, fall into three groups:

| Pension Scheme Type | Description | Tax Exemption Details |

|---|---|---|

| Government | Pensions for Central/State Government employees including civil service and armed forces. | Full exemption on commuted pension without limit. |

| Private | Pensions from recognized superannuation funds managed by employers. | One-third exemption if gratuity received; half exemption if not. |

| Third-party Self Purchased | Pensions from approved funds set up by life insurers like LIC. | Full exemption subject to fund approval and conditions. |

This explanation helps you know if your pension scheme qualifies for tax benefits under the new bill.

For more details, you can visit the official Income Tax Department website: https://www.incometaxindia.gov.in